- Legislature Home /

- Senate /

- Senator Mark Lipparelli

Contact

Senator Mark Lipparelli

Party: Republican

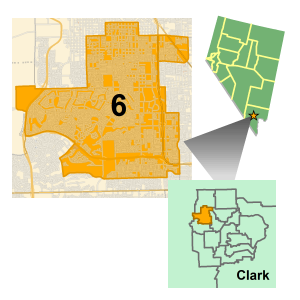

District: 6

County: Clark (Part)

Legislative Service

- Nevada Senate, 2015 (appointed to Senate in 2014)

Honors and Awards

- Global Gaming Business, "Top Ten Under 40"

- International Masters of Gaming Law, Regulator of the Year

Affiliations

- Board Trustee, University of Nevada Foundation

- Board Member, National Center for Responsible Gaming

- Co-Moderator, Executive Development Program

- Member, International Association of Gaming Advisors

- Member, International Masters of Gaming Law

- Member, Gaming Law Advisory Board, University of Nevada, Las Vegas, William S. Boyd School of Law

- Member, Legislative Committee to Conduct an Interim Study Concerning the Impact of Technology Upon Gaming, 2014

- Board Member and Treasurer, International Association of Gaming Regulators, 2010 - 2012

- Member, Nevada Gaming Policy Committee, 2011 - 2012

- Vice Chair and Board Member, Gaming Standards Association

Education

- University of Nevada, Reno, B.S., Finance

- University of Nevada, Reno, M.S., Economics

- Institute for the Study of Gambling & Commercial Gaming, Executive Development Program

Professional

- Chairman, Nevada State Gaming Control Board, 2011 - 2012

- Board Member, Nevada State Gaming Control Board, 2009 - 2010

- Executive Vice President, Bally Technologies, 2004 - 2008

- President/Executive Vice President, Shuffle Master, 2001 - 2003

- Chief Financial Officer, CAMCO, Inc., 1999 - 2001

- Executive Vice President, Enterainment Systems, Bally Gaming, Inc., 1997 - 1999

- Vice President of Finance, Casino Data Systems, 1993 - 1997

Personal

Occupation: Consultant, Business Owner

Born: 1965 - Elko, Nevada

Born: 1965 - Elko, Nevada

Committees Serving

Primary Sponsor

| SB133 | Authorizes the reimbursement of teachers for certain out-of-pocket expenses. (BDR 34-118) |

| SB167 | Revises provisions relating to employment. (BDR 18-265) |

| SB168 | Revises provisions relating to collective bargaining by local government employers. (BDR 23-602) |

| SB170 | Provides for a partial abatement of certain taxes for new or expanding data centers and related businesses in this State. (BDR 32-765) |

| SB175 | Makes various changes relating to public safety. (BDR 15-515) |

| SB212 | Revises provisions governing discipline of pupils and prohibited acts at public schools. (BDR 34-177) |

| SB240 | Makes certain changes relating to public safety. (BDR 14-955) |

| SB264 | Exempts spendthrift trusts from the application of the periods of limitation set forth in the Uniform Fraudulent Transfer Act. (BDR 10-780) |

| SB266 | Revises provisions relating to the tax on live entertainment. (BDR 32-720) |

| SB320 | Revises provisions relating to time shares. (BDR 10-1034) |

| SB325 | Revises provisions relating to state purchasing. (BDR 27-1024) |

| SB329 | Revises provisions relating to partnerships. (BDR 7-784) |

| SB330 | Revises provisions relating to education. (BDR 34-724) |

| SB390 | Revises provisions relating to charter schools. (BDR 34-78) |

| SB409 | Revises provisions related to gaming. (BDR 41-1041) |

| SB412 | Provides for a credit against taxes imposed on certain employers that make a matching contribution to certain college savings plans. (BDR 32-1033) |

Co-Sponsor

| ACR3 | Honors Nevadans who have lost their lives in the Global War on Terrorism. (BDR R-202) |

| SR4 | Inducts Dean Rhoads into the Senate Hall of Fame. (BDR R-1268) |

| ACR4 | Memorializes former Assemblyman Joseph “Joe” Michael Hogan, Sr. (BDR R-1260) |

| ACR5 | Memorializes former Assemblyman Peter L. “Pete” Livermore. (BDR R-1259) |

| SR5 | Inducts Terry Care into the Senate Hall of Fame. (BDR R-1270) |

| SR6 | Inducts Randolph J. Townsend into the Senate Hall of Fame. (BDR R-1269) |

| SCR8 | Commemorates the 30th anniversary of the sister-state relationship between the State of Nevada and Taiwan. (BDR R-1265) |

| SB192 | Revises provisions relating to sexual conduct between certain persons. (BDR 14-731) |

| SB250 | Revises provisions relating to policies of health insurance. (BDR 57-687) |

| SB261 | Makes various changes relating to certain research facilities. (BDR 50-56) |

| SB262 | Revises provisions relating to guardians. (BDR 13-643) |

| AB300 | Creates the Office of the Inspector General in the Department of Administration. (BDR 18-581) |

| SB333 | Revises provisions governing the homestead exemption. (BDR 10-971) |

| SB334 | Proposes to exempt sales of certain durable medical equipment, mobility-enhancing equipment, hearing aids, hearing aid accessories, and ophthalmic or ocular devices or appliances from sales and use taxes and analogous taxes. (BDR 32-262) |

| SB386 | Revises provisions relating to motor vehicles. (BDR 40-675) |

| SB391 | Revises provisions governing educational instruction in the subject of reading. (BDR 34-644) |